If you are managing a chronic condition such as diabetes or a musculoskeletal condition - it’s particularly important to find a plan that will meet your health care needs and your budget.

It’s that time of the year again: Open enrollment, the only time each year you can enroll in or change your health insurance plan without a qualifying life event (like getting married, having a baby, or losing other health coverage).

You’ll have a variety of choices – and if you are managing a chronic condition such as diabetes or a musculoskeletal condition, it’s particularly important to find a plan that will meet your health care needs and your budget. Consider these tips for finding the right fit.

1. Look at all of the costs, not just the premium

- The premium is the amount you pay to be covered by an insurance plan. When it comes to total cost, however, the premium is just the beginning.

- If you’re shopping on the ACA exchange, check if you qualify for a subsidy – in the form of a tax credit – to lower your expenses. Subsidies are based on income, and in many cases, people pay little or no premium after their subsidy is applied.

- The deductible is the amount you’ll pay out of pocket before your insurance begins to cover its portion of the costs. In some plans, a single deductible applies to health care services and medicines. In other plans, you’ll have two deductibles: One for medical, one for pharmacy. Most plans – including all ACA plans – provide basic preventive care (such as annual check-ups) at no out-of-pocket cost to you, even before you meet your deductible.

- After you meet your deductible, you’ll be responsible for the coinsurance, which is a percentage of the total cost of your covered medical bills. For example, if your coinsurance is 20% and the total cost is $50, you’ll pay $10 and your insurance will pay $40. Alternatively, some benefits include a copay, which is a fixed dollar amount you pay for some medical treatments instead of a percentage of the doctor’s charges. For example, you might have a $30 copay for a visit to your primary care doctor. All preventive visits have $0 out-of-pocket costs.

- The out-of-pocket maximum is just that – the most you will pay for covered expenses during the year. It includes deductibles, copays, and coinsurance – everything but the premiums. If you reach the out-of-pocket maximum, the health plan will pay 100% of covered medical and prescription costs for the rest of the year.

2. Confirm your doctors are in-network and ensure your medications are covered

A “provider network” is a group of health care practitioners who have agreed to offer their services at pre-negotiated rates. Being “in-network” means a provider has a contract with your insurer, which typically results in lower out-of-pocket costs, high quality care, and greater access to care for patients.

Before you select a plan, you’ll want to evaluate the plan’s network to see which doctors are available to you in-network. This may be especially important if you have a preferred specialist that you see for a chronic condition. Once enrolled, if you go out-of-network, you generally will need to pay a larger amount of your own money out of pocket. In some cases, your out-of-network care may not be covered – leaving you responsible for the entire cost.

If you are living with a chronic condition, you may be on medication to manage your health. When selecting a health insurance plan, ensure that your prescriptions are covered. Pay attention to tier levels, as higher tier levels usually cost more. You’ll also want to understand requirements such as prior authorization or step therapy.

3. Pick the type of insurance plan that’s right for you

The types of health plan options include health maintenance organizations (HMOs), exclusive provider organizations (EPOs), point-of-service (POS) plans, and preferred provider organizations (PPOs). Some plans require you to choose a main doctor, called a primary care physician, who will refer you to a specialist if you need one. Some plans let you see doctors outside their network, but it usually costs more, while other plans don’t cover out-of-network care at all. Usually, plans with more rules and limits will have lower premium costs. Think about how and where you access care to determine which plan types will work for you.

4. Consider your family’s needs and medical conditions

Although the monthly premium may be higher, a plan with lower deductibles and lower coinsurance might be right for people with chronic conditions, who often require regular medication and frequent doctor appointments and are more likely to need to be hospitalized or undergo surgery. Check whether plans offer any added-value benefits specific to your conditions, such as caps on the amount you pay monthly for medications or supplies.

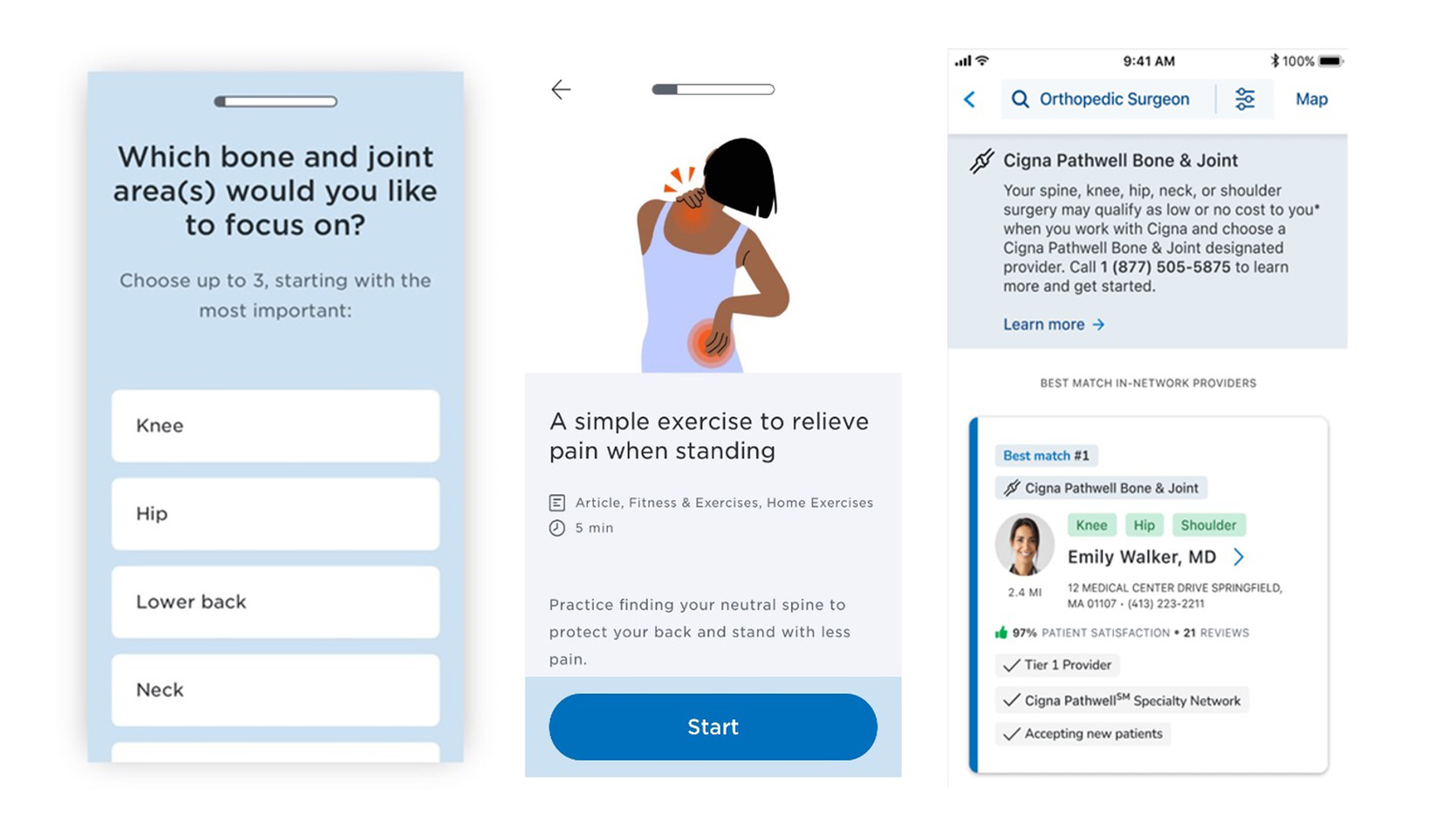

Some insurers offer condition-specific programs and plans that can help keep costs down. Patients pay little or nothing for select equipment and supplies, preventive care, common medications and the medical services they need to manage their conditions. As you shop, check for plans that offer additional value to you through medication assistance programs and disease management programs. For example, the Cigna Pathwell Bone & Joint ® program by Cigna Healthcare is designed to help people with bone, joint, or muscle conditions get the care and support they need, every step of their health care journey.

Pictured above: Cigna Healthcare Pathwell Bone & Joint digital experience.

The program uses advanced technology and expert guidance to create a personalized care plan, connecting you to high-quality, affordable doctors and specialists. If surgery or travel is needed, Pathwell Bone & Joint also helps coordinate those benefits. If you meet the program qualifications and choose a designated Pathwell provider for your surgery, your surgery may be covered at no out-of-pocket cost to you. This support can make a big difference in both your health and your costs.

To find out if a plan offers mental health coverage, look for “mental health,” “behavioral health,” or “substance abuse services” in the Summary of Benefits. This document explains which services are covered and how much they will cost. Also check the plan brochure for features about mental health care access and costs. For example, Cigna Healthcare’s plans offer a large network of in-person and virtual providers plus virtual access to board-certified doctors and behavioral care providers through MDLIVE.

If you and your spouse or partner each have access to employer plans, check to see which provides the most affordable premiums, lowest deductibles, and a network with your preferred doctors. Consider how much you would pay if you had lower or higher health care needs during the year and be sure to look at the premiums and deductibles when just the employee is covered vs. the entire family. You might decide that each of you should sign up with your own employer, or you might select one plan for your whole family.

How to choose the right plan

The right coverage depends on your individual needs.